February 23, 2024

How Much Does it Cost to Sell a House (Complete Breakdown)

Selling a house can be an exciting and rewarding experience, but it also comes with a price tag. There are many costs involved in selling a home, some of which are necessary and some of which are optional.

Knowing these costs and how to minimize them can help you save money and maximize your profit.

In this blog post, we’ll do a deep dive into the cost of selling a house at three different home sales prices: $200,000, $400,000 (very close to the national average for a single-family home), and $600,000.

By the end of the post, you’ll be able to estimate how much selling your home will cost and how to budget accordingly.

Cost of Selling a House: Necessary Expenses

Necessary expenses are the costs you must pay when selling a house, regardless of the market conditions, the type of property, or the buyer’s preferences. These costs include:

Real Estate Agent Commissions

Paying real estate agent commissions is one of the most significant costs of selling a house. They’re the fees you pay to the agents representing you and the buyer in the real estate transaction.

In the US, real estate agents can expect an average commission between 5% and 6% of the home's sale price. This commission is split between the seller's and buyer's agents. On average, the seller's agent (also known as the listing agent) charges 2.83%, while the buyer's agent charges 2.66%.

However, these percentages vary depending on the area, property, and agent negotiation skills. Average rates go from 4.78% in Hawaii to 6.67% in West Virginia.

Average real estate agent commission by region (Image source)

Real estate commissions are usually negotiable. Still, you should be careful not to compromise the quality of service. A good agent can help you sell your house faster and for a higher price, offsetting the commission cost, which averages around $22,000.

Capital Gains Taxes

Another major selling expense is the tax you pay on the profit you make from selling your house or capital gains tax. The profit is calculated by subtracting the selling price from your property's adjusted basis.

In turn, the adjusted basis is the original purchase price plus any improvements you made to the property minus any depreciation you claimed.

Profit = (Sale Price) - (Adjusted Basis)

Adjusted Basis = (Purchase Price) + (Improvements) - (Depreciation)

The capital gains tax rate depends on your income tax bracket, tax filing status, and how long you owned the property before selling.

If you owned the property for over a year, you'll pay the lower** long-term capital gains tax rate**, which ranges from 0% to 20%. If you owned the property for less than a year, you’ll pay the short-term capital gains tax rate, which is the same as your ordinary income tax rate.

The following table shows the income brackets and capital gains tax rates for 2024.

For example, suppose you're an average American household with a joint income of around $75,000, selling the house you've lived in for the past 18 months for the national average profit margin of 44%. The following table shows how much you would pay in capital gain tax depending on the sale price.

The above means that the average American household will pay about $23,500 in capital gains tax when selling their home.

However, there are ways to minimize or avoid the capital gains taxes when selling a house. The most common way is to use the primary residence exclusion, which allows you to exclude up to $250,000 of the profit if you are single or up to $500,000 if you are married.

Primary residence exclusion (the 2-out-of-5-year rule) (Image source)

Another way to reduce the capital gains taxes if you’re selling an investment property is to reinvest the profit into another property within 180 days of the sale through a 1031 exchange. This exchange allows you to defer the taxes until you sell the new property.

Because capital gains taxes can be complicated and vary depending on your situation, it's advisable to consult a tax professional before selling your house. They can help you calculate your profit, tax liability, and potential savings.

Property Tax:

Property tax is the tax you pay to the local government for owning a property, such as a house. The property tax rate varies by location and is usually a percentage of the assessed value.

Here are the average property tax rates and the property taxes in different states depending on the home sale price.

Prorating Property Taxes

Selling your house means you won’t own it for the entire year, so you must prorate the property tax between you and the buyer. Prorating means that you pay the property tax only for the portion of the year that you owned the property. The buyer will pay the property tax for the portion of the year that they will own the property.

For example, if you sell your house on June 30, you'll pay half of the annual property tax, and the buyer will pay the other half, or $2,200, for an average home sold for $400,000.

Transfer Tax

When you transfer the ownership of your property to the buyer, you must pay transfer taxes to the state or local government. The transfer tax rate depends on the property’s location and value. Some states, like Arizona, have a flat fee, while others charge a percentage of the sale price.

In addition to the state transfer tax, some cities or counties may also charge a local transfer tax.

The transfer tax is usually paid at the closing, along with the other closing costs, by the seller unless the buyer agrees to pay it or it is customary for the buyer to pay it in the area.

Title Insurance for the Buyer

The title is the legal document proving the property's ownership. A defect or a lien on the title can affect the buyer’s ability to own or use the property or the lender’s ability to foreclose on the property in case of default. Title insurance protects the buyer and the lender from any defects or liens on the property title.

Breakdown of title insurance costs (Image source)

The cost of title insurance varies by location, property value, and coverage. The average cost of title insurance in the US goes from about $2,000 to $3,500, sometimes a percentage of the home's value.

Title insurance is usually paid by the seller and usually at the closing, along with the other closing costs.

Your Current Mortgage Payoff

If you have a mortgage on the house you’re selling, you must pay it off first. The mortgage payoff includes the principal balance, any owed interest, and applicable fees or penalties (usually between 1% and 5%).

Therefore, it's dependent on the total amount you initially borrowed, the type of mortgage, your mortgage rate, how many payments you've already made, and other factors.

Calculating the correct payoff amount yourself is no easy feat, but the following table gives you some estimates to give you an idea. It shows how much the average American will pay if they sell a house five years after getting an average 30-year fixed mortgage at a 3% fixed rate and an early exit fee of 2%.

The table assumes the same 44% profit margin as before, so for a house selling today at $200,000, the original loan would have been around $140,000.

You'll need to pay the payoff amount at the closing, and the lender will release the lien on your property. You can precisely determine how much it will cost to repay your mortgage at closing by requesting a payoff statement from your lender.

Information in a payoff statement (Image source)

Depending on your home equity, the mortgage payoff can be the most significant cost when selling your house.

You must ensure that the proceeds from the sale are enough to cover your mortgage payoff. Otherwise, you'll have to bring cash to the closing or negotiate a short sale with your lender.

Home Repairs

Home repairs are the costs you incur to fix any damages or defects on your property before selling it. Home repairs can include repairing or replacing:

-

Electrical installations

-

HVAC systems

-

Foundations

-

Plumbing

-

Roofs

Home repairs are necessary to make your house more appealing and functional for buyers and avoid any issues during the inspection or the appraisal.

Since this can vary wildly from a couple of hundred dollars to tens of thousands, we'll take a conservative estimate and use the average cost of home repairs in the US, which is around $5,000, including the cost of a pre-inspection assessment from a professional home inspector.

Moving Costs

Selling a house implies taking your things out before the new owners move in. Doing so implies moving costs, such as:

-

Storage fees if you need to store your items temporarily before or after the move

-

Packing services, if you hire professionals to pack your items for you

-

Moving truck rental or moving company fees

-

Packing materials and supplies

-

Travel expenses

-

Insurance

The cost of moving depends heavily on the distance, size, weight, mode of transportation, and moving company. The US is a big country, so the average cost of moving in the US can go from as little as $2,000 for a local move within your city or state to as much as $8,000 if you're moving coast-to-coast. Since most people don't move that far away, the average is closer to around $4,000.

Average moving costs (Image source)

You can save money on moving costs in several ways, like decluttering your items and selling, donating, or discarding the ones you don’t need or want anymore. Shopping around for lower rates and packaging and moving everything yourself will save you hundreds, if not thousands, of dollars.

Summary of Necessary Expenses

The following table summarizes all the necessary expenses for selling a home in the US discussed above as a function of the sale price, assuming only 60 mortgage payments on a 30-year fixed mortgage at a 3% rate and a capital gain margin of 44%:

There may also be other expenses, such as real estate attorney fees and administrative fees related to the mortgage payoff, but the ones outlined above are the most important.

Cost of Selling a House: Optional Expenses

The above expenses are unavoidable when you sell a house. However, there are other optional expenses you may want to consider to get a better price or to sell your house faster. These optional expenses include:

Home Improvements

Home improvements are the costs of upgrading or enhancing your property before selling it. Unlike repairs, home improvements or renovations are optional and include anything from installing new appliances to adding a new room. They can increase your property's value and appeal, helping you sell it faster for a higher price.

The cost of home improvements depends on the project's scope and quality and the contractor you hire to do the work.

Three of the most common and profitable home improvements are:

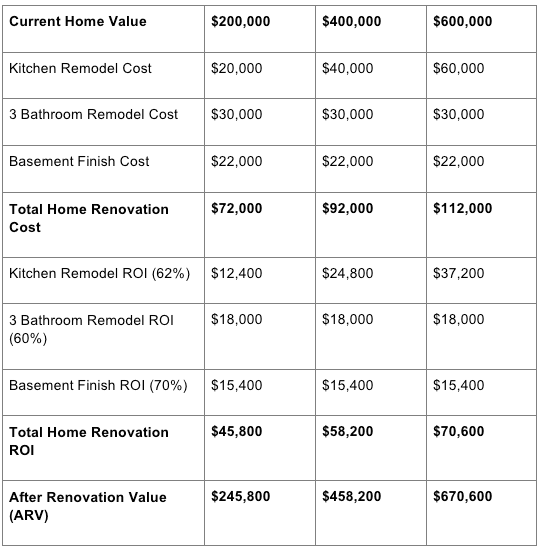

So, if you invest in redoing your kitchen, three bathrooms, and your basement, the total average costs and expected ROI will be:

It's important to note that, at these ROIs, even though you'll be able to sell your house for a higher price, the extra return won't cover your investment in the renovation.

However, it may attract more buyers and help you sell your house faster, and you may pull off a higher ROI, depending on your circumstances. Consequently, you should always consult with your agent about what improvements are worthwhile for your property.

Pre-Sale Home Inspection

A pre-sale home inspection is a comprehensive examination of the condition and functionality of your property by a licensed home inspector. A pre-sale home inspection is optional because it's not required to sell your house, but it can benefit you in several ways, such as:

-

Avoid surprises during the buyer’s inspection or appraisal, like lawsuits or claims from the buyer after the sale

-

Giving you more time and control to make the repairs

-

Identifying issues before selling your house

-

Increasing the buyer’s confidence

A pre-sale home inspection can also provide evidence of your home's condition when purchasing a home warranty policy for extra reassurance.

The cost of a pre-sale home inspection varies by location, property size, and inspector qualifications. The average cost of a pre-sale home inspection in the US is around $400 (ranging from $200 to $600) and is usually paid by the seller upfront before the inspection.

Seller Concessions

You may want to give your buyer certain concessions if the real estate market favors the buyer. These seller concessions include:

-

Repairs that come up after the inspection or the appraisal

-

Mortgage-rate buydowns

-

Loan origination fees

-

Moving expenses

-

Home warranty

-

Closing costs

Seller concessions are a matter of negotiation between buyers and sellers, but they have limits. These limits depend on the buyer’s type of mortgage loan and are usually expressed as a percentage of the sale price or the appraised value, whichever is lower.

The limits on seller concessions for different types of mortgage loans are shown below.

The negotiation between the seller and the buyer determines the actual amount and the type of seller concessions that the seller will offer. Several factors can influence the negotiation, such as:

-

The seller’s motivation, such as urgency, goals, etc.

-

The buyer’s financial situation

-

The property’s conditions

-

Market conditions

Last year, almost 42% of home sellers agreed to pay seller concessions ranging from 0.9% to 2.6%, averaging 1.75% of the sale price. Here’s what that looks like for our examples.

Home Staging

Home staging is the process of preparing, furnishing, and decorating your property to attract potential buyers. Home staging isn't required to sell your house but can help your sale by:

-

Reducing the time on the market and the number of price reductions

-

Increasing the chances of getting a full- or above-listing-price offer

-

Increasing the perceived value of your property

-

Increasing the number of offers

There are three approaches to home staging:

-

Traditional home staging - here, you physically stage the house with furniture and accessories, usually with the help of a professional stager or interior designer. Home staging costs depend on your property's size, condition, and style. The average cost is between $2,760 and $4,400 per month.

-

Virtual staging with a designer - this is a process of creating realistic images of furnished rooms using graphic editing software. A graphic designer takes professional photographs of the property and edits them according to the homeowner's or real estate professional’s expectations. Edits can include decluttering, 3D modeling, and more. The average cost for virtual staging is between $59 and $129 per photo.

-

Virtual staging with AI - using AI to virtually stage a property offers benefits that graphic designers can’t, including faster turnaround times and much lower cost. Virtual Staging AI is a pioneer in the field with its AI developed at Harvard Innovation Labs. This tool can declutter and create beautiful virtually staged rooms, all for a fraction of the cost of virtual staging and in a matter of seconds.

Virtual Staging AI before and after images (Image source)

Virtual Staging AI pricing (Image source)

How much does home staging cost?

Let's compare the costs of the three approaches, assuming 20 photos for a property the average number of photos in real estate listings.

As you can see, the difference is overwhelming. Classic staging only makes sense for luxury real estate, where high property prices and demanding clients make it the right choice. For everything else, Virtual Staging AI is a smarter option.

Summary of Optional Expenses

The following table summarizes all the optional expenses for selling a home in the US as a function of the sale price, including the different types of home staging:

A Successful Sale

Many costs go into selling a house; some are strictly necessary, while others are optional.

These costs depend on many factors, such as the sale price, location, property type, market conditions, buyer preferences, and the seller’s choices. It's also strongly influenced by how much equity you have on the property.

Without including the mortgage payoff, selling a home can cost around 14.6% to 17.0% of the sale price. The total cost can be significantly higher if you still owe a significant portion of your mortgage.

Optional costs such as home improvements, seller concessions, and traditional home staging can increase the cost by 20% to 40%.

There are several ways to save money when selling a house, like doing renovations yourself, decluttering to save on moving costs, and consulting with a tax professional to save on taxes.

However, one of the easiest and most convenient ways to save money and sell your house faster and for a higher price is to stage your home virtually using Virtual Staging AI. Virtual staging can help you showcase the potential of your property and attract more buyers without spending a lot of time and money on physical staging.

Don’t miss this opportunity to improve your ROI with virtual staging. Try Virtual Staging AI for free today and see the difference!